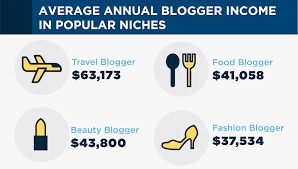

Finance Blogs

12 Personal Finance Blogs Income Reports

The personal finance niche is lucrative mainly because of the high ad revenues and affiliate commissions. There are also many lucrative sub-niches within the personal finance niche including credit cards, stock trading, or insurance.

A personal finance blog can help you make an income if you have a passion for teaching others how to manage their money.

The top bloggers in this niche can earn over a million dollars a year through ad revenue, affiliate commissions, and selling products and services. This is 20 times more than what an average American earns in a year.

While these incomes are not typical, they show what is possible with hard work and dedication.

Examples of successful personal finance blogs

In this article, you will see 13 examples of personal finance bloggers who are making a full-time or part-time income from blogging. The article includes short bios of personal finance bloggers, earnings per month, blog traffic, monetization methods, profitability, and blog age.

The information comes from income reports from personal finance bloggers. The featured income reports cover a period from 2016 to 2021.

Quick insights from personal finance blogs

Here are some quick insights from the income reports:

- Personal finance bloggers on this list mostly made money from affiliate marketing and selling their own products.

- Some of the popular personal finance niches included retire-early (FIRE), investing, and personal finance for retirees.

- The highest-earning personal finance blogger on this list (Michelle Schroeder-Gardner) made $139,233 in one month.

If you are interested in starting a blog but don’t know how to start, check out the article below. It will take you step-by-step through the process of starting a blog.

Personal Finance Blogs Income and Traffic Reports

Let us explore the personal finance blogs traffic and earnings reports in detail.

1. Making Sense of Cents

Making Sense of Cents is a personal finance and lifestyle blog started by Michelle Schroeder-Gardner. She started her blog to keep track of her progress in clearing a $38,000 student loan debt. Making Sense of Cents is one of the better-known blogging success stories and has been featured by various mainstream media outlets such as Forbes, Business Insider, and Oprah. The success of her blog has enabled her to travel full-time with her husband.

- Monthly income: $139,233 (January 2017 income report)

- Monthly traffic: 790,000 Pageviews

- RPM: $176

- Income sources: Ad Revenue (2.4%), Affiliate Income (50.2%), Sponsorship (12.2%), Products (35.2%)

- Profitability: 94.2%

- Blog age at the time of the report: 5 years (Started in 2012)

2. Believe in a Budget

Believe in a Budget is a personal finance blog that was started by Kristin Larsen. She was able to quit her job as an interior architect and designer after only 10 months of blogging. In her third year of blogging, she made $290,000. She made most of her money in 2018 from selling courses on her blog

- Monthly income: $109,879 (April 2018 income report)

- Monthly traffic: 200,000 Pageviews

- RPM: $549

- Income sources: Ad Revenue (0.9%), Affiliate Income (7.8%), Products (91.3%)

- Profitability: 93.6%

- Blog age at the time of the report: 3.3 years (Started in 2015)

3. DollarSprout

DollarSprout was started by two Virginia Tech alumni, Jeff Proctor and Ben Huber. Before launching DollarSprout, Jeff worked in private wealth management while Ben worked as a clinical administrator for a regional hospital network. DollarSprout aims to help readers maximize their earning potential, whether that’s through finding a side hustle, moving up in their career, or building passive income streams. They made most of their income in 2018 from affiliate marketing.

- Monthly income: $104,097 (December 2018 income report)

- Monthly traffic: 742,077 Pageviews

- RPM: $140

- Income sources: Ad Revenue (1%), Affiliate Income (98.3%), Products (0.7%)

- Profitability: 81.7%

- Blog age at the time of the report: 3.7 years (Started in 2015)

4. Busy Budgeter

The Busy Budgeter was started by Rosemarie Groner. Rosemarie spent 10 years as a state trooper before quitting her job to start a home day-care business so that she could stay home with her son. She started her blog to help people budget and save money so that they could enjoy a simpler life. Most of her income in 2017 came from selling products (workbooks and cheat sheets).

- Monthly income: $86,439 (January 2017 income report)

- Monthly traffic: 505,239 Pageviews

- RPM: $171

- Income sources: Ad Revenue (5.5%), Affiliate Income (22.3%), Sponsorship (4.2%), Products (68%)

- Profitability: 76.9%

- Blog age at the time of the report: 2.3 years (Started in 2014)

5. Millennial Money Man

Millennial Money Man is a personal finance blog started by Bobby Hoyt, a former high school band director. He was inspired to start blogging about personal finance after paying off a $40,000 debt in 18 months. In 2018, he made most of his money from selling courses on Facebook ads and blogging.

- Monthly income: $53,212 (July 2018 income report)

- Monthly traffic: 178,934 Pageviews

- RPM: $279

- Income sources: Ad Revenue (1.9%), Affiliate Income (4.7%), Products (80.6%), Services (12.8%)

- Profitability: 87.1%

- Blog age at the time of the report: 3.5 years (Started in 2015)

6. The Savvy Couple

The Savvy Couple was started by Kelan and Brittany Kline in 2016. In three years, they were able to pay off $25,000 in student loans and grow The Savvy Couple into a multi-six figure online business. The blog has enabled them to quit their full-time jobs and accumulate a net worth of over $200,000 by age 29.

- Monthly income: $43,547 (May 2019 income report)

- Monthly traffic: 250,000 Pageviews

- RPM: $174

- Income sources: Ad Revenue (11.6%), Affiliate Income (8.6%), Sponsorship (77.5%), Products (2.3%)

- Profitability: 91.1%

- Blog age at the time of the report: 2.8 years (Started in 2016)

7. Caroline Vencil

Caroline Vencil is a personal finance blog started by Caroline Vencil in 2015 to share strategies she and her husband used to enable them to live on a $17,000 a year income for four years. In just three years of blogging, she was able to make more in one month than they used to make a year.

- Monthly income: $25,871 (November 2018 income report)

- Monthly traffic: n/a

- RPM: n/a

- Income sources: Ad Revenue (7.3%), Affiliate Income (37.8%), Products (54.9%)

- Profitability: 88.6%

- Blog age at the time of the report: 3.3 years (Started in 2015)

8. Finsavvy Panda

Finsavvy Panda was started by Ling Tran from Toronto, Canada, to document her financial journey as well as make some extra money. After her first year of blogging, she was consistently earning $10,000 a month. In 2020, she was making over $20,000 a month after only 3 years of blogging.

- Monthly income: $22,343 (November 2020 income report)

- Monthly traffic: n/a

- RPM: n/a

- Income sources: Ad Revenue (22.7%), Affiliate Income (68%), Products (9.3%)

- Profitability: 93.2%

- Blog age at the time of the report: 3.3 years (Started in 2017)

9. The Money Ninja

The Money Ninja was started by John Pham from Boston, MA (US). A son of Vietnamese immigrants, John has made over a million dollars outside of his real job. He uses his blog to show readers how to make more money, save it better, and spend it more wisely. The Money Ninja made over 99% of its income in 2020 from affiliate marketing, which explains the exceptionally high RPM.

- Monthly income: $10,385 (Jan-March 2020 income average)[ 3-month total $31,040.48]

- Monthly traffic: 47,594 Pageviews [3-month traffic]

- RPM: $655

- Income sources: Ad Revenue (0.5%), Affiliate Income (99.5%)

- Profitability: n/a

- Blog age at the time of the report: 4.2 years (Started in 2015)

10. Stock Millionaires

Stock Millionaires is a niche blog that was started by Russell and Maleah Barbour to review stock trading and investing educational products. Within 3 years of blogging, the blog was making over $7k with only 10,000 Pageviews.

- Monthly income: $7,233 (February 2018 income report)

- Monthly traffic: 10,000 Pageviews

- RPM: $723

- Income sources: Affiliate Income (100%)

- Profitability: n/a

- Blog age at the time of the report: 3.2 years (Started in 2015)

11. Freedom in a Budget

Freedom in a Budget is a personal finance and lifestyle blog started by Kelly Anne Smith from South Florida (US) as a side hustle. Kelly and her husband used the income from their blog to pay off debt, pay for their wedding, buy a new car and save for a down payment for their first home.

- Monthly income: $5,046 (May 2021 income report)

- Monthly traffic: n/a

- RPM: n/a

- Income sources: Ad Revenue (34.5%), Affiliate Income (54.4%), Products (8.4%), Services [Coaching] (1.8%), Other [Donations] (0.9%)

- Profitability: n/a

- Blog age at the time of the report: 4.7 years (Started in 2016)

12. The Practical Saver

The Practical Saver was started by Allan Liwanag, a Maryland (US) based analyst to share ideas on paying off debts, budgeting, and making money. He managed to earn over $5k a month in just 8 months of blogging, with the majority of his income coming from affiliate marketing and sponsorships.

- Monthly income: $5,243 (September 2016 income report)

- Monthly traffic: 174,882 Pageviews

- RPM: $30

- Income sources: Ad Revenue (15%), Affiliate Income (52.8%), Sponsorship (32.2%)

- Profitability: n/a

- Blog age at the time of the report: 8 months (Started in 2016)

13. The Money Habit

The Money Habit was started by J.P. Livingston, an anonymous personal finance blogger who retired at the age of 28 with 2.25 million dollars. In 2017, J.P was able to make $62,326 blogging only 5 hours a week. In 2017, she made over 96% of her income from affiliate marketing.

- Monthly income: $5,139 (Average for 2017)

- Monthly traffic: 100,000 Pageviews (Average for 2017)

- RPM: $52

- Income sources: Ad Revenue (3.5%), Affiliate Income (96.5%)

- Profitability: n/a

- Blog age at the time of the report: 1.4 years (Started in 2016)

Final Thoughts

The personal finance niche is highly lucrative as can be seen from the high RPMs. However, it is also quite competitive and you will be going against big sites in this space.

If you are passionate about personal finance, you can start a blog in this niche. To reduce your competition, choose a less competitive sub-niche or focus on a particular audience (for example, personal finance for retirees).

With a bit of strategic planning, you can make good money blogging about personal finance.

You can easily start a blog these days even if you lack the technical skills. If you intend to make money from your blog, you need to set it up correctly from the start.

Finance Blogs

50+ Inspiring Anne Lamott Quotes for Writers

Anne Lamott is a bestselling author of numerous fiction and non-fiction books. In this article, we will explore her quotes which a packed full of excellent advice for writers. The quotes are drawn from various sources including her interviews, talks, and her book on writing, Bird by Bird.

The quotes will help you to deal with different challenges that face writers including:

- How to be consistent in writing

- How to get ideas for writing

- How to deal with self-doubt and fear

If you want to learn more about Anne Lamott, check out her quick biography.

Quotes on Why You Should Write

1. You’re going to feel like hell if you wake up someday and you never wrote the stuff that is tugging on the sleeves of your heart: your stories, memories, visions and songs -your truth, your version of thing – in your own voice. That’s really all you have to offer us, and that’s also why you were born. – Ted Talk, 2017

2. Maybe what you’ve written will help others, will be a small part of the solution. You don’t even have to know how or in what way, but if you are writing the clearest, truest words you can find and doing the best you can to understand and communicate, this will shine on paper like its own little lighthouse. – Bird by Bird, 1995

3. I’ve written 13 books now. It’s not really important that I write a lot more books, but I do it as a debt of honor. I got one of the five golden tickets to be a writer, and I take that seriously. – Goodreads Interview, 2012

4. I don’t love my own work at all, but I love my own self. I love that I’ve been given the chance to capture the stories that come through me. – Goodreads Interview, 2012

5. Writing taught my father to pay attention; my father in turn taught other people to pay attention and then to write down their thoughts and observations. – Bird by Bird, 1995

6. Writing has so much to give, so much to teach, so many surprises. That thing you had to force yourself to do – the actual act of writing – turns out to be the best part. – Bird by Bird, 1995

7. Writing and reading decrease our sense of isolation. They deepen and widen and expand our sense of life: they feed the soul. – Bird by Bird, 1995

8. When writers make us shake our heads with the exactness of their prose and their truths, and even make us laugh about ourselves or life, our buoyancy is restored. We are given a shot at dancing with, or at least clapping along with, the absurdity of life. – Bird by Bird, 1995

Quotes on Success in Writing

9. I love the freedom success has given me, to do and write anything I want. – Washington Post Interview, 2021

10. I try to use my visibility for the most good I can. – Washington Post Interview, 2021

11. I’ve seen celebrity destroy infinitely more people than it’s fulfilled. – Washington Post Interview, 2021

12. Publication and temporary creative successes are something you have to recover from. They kill as many people as not. They will hurt, damage and change you in ways you cannot imagine. – Ted Talk, 2017

13. The most degraded and evil people I’ve ever known are male writers who’ve had huge best sellers. – Ted Talk, 2017

14. It’s also a miracle to get your work published, to get your stories read and heard. Just try to bust yourself gently of the fantasy that publication will heal you, that it will fill the Swiss-cheesy holes inside of you. It can’t. It won’t. But writing can– Ted Talk, 2017

15. My dad was a writer, and his entire life was about trying to get on the New York Times list. When it happened to me, I called my mom and said, “Oh my God, Mom, I hit the list!” And my mom said, “Oh, huh. Anything else?” I just wanted to hang up. That was my entire childhood. – Washington Post Interview, 2021

16. And then I did get on again, and then I went higher on the list, and then I fell off, and I wanted to die. Thereby proving the adage, “Happiness is an inside job.” That’s where I try to keep my attention, such as it is: on the inside. – Washington Post Interview, 2021

Quotes on Books and Reading

17. No matter how people mess with you or let you down, or how you let yourself down, a good book means that when you get in bed that night, you have a good hour. – Goodreads Interview, 2012

18. That’s what books mean to me. I can open this two-dimensional, flat white page with squiggly little black marks on them, and someone has created this world that you’re going to enter into and get lost in Berlin in the ’30s. – Goodreads Interview, 2012

19. For some of us, books are as important as almost anything else on earth. What a miracle it is that out of these small, flat, rigid squares of paper unfolds world after world after world, worlds that sing to you, comfort and quiet or excite you. – Bird by Bird, 1995

20. When I read these books that I love so much, I am simultaneously filled with joy and gratitude and relief for their existence, and total jealousy that they are so great, these writers capable of creating entire worlds that shimmer with truth and humanity. – Lithub Interview, 2021

21. Becoming a better writer is going to help you become a better reader, and that is the real payoff. – Bird by Bird, 1995

22. One reads with a deeper appreciation and concentration, knowing now how hard writing is, especially how hard it is to make it look effortless. You begin to read with a writer’s eyes. – Bird by Bird, 1995

Quotes on Getting Started, Consistency and Persistence in Writing

23. You try to sit down at approximately the same time every day. This is how you train your unconscious to kick in for you creatively. – Bird by Bird, 1995

24. The model was my father who was a writer, Kenneth Lamott. And he had a lot of books published and a lot of magazine articles. And I heard him down at his desk at that old Olympia at 5:30, every morning, rain or shine or hangover, he just did it. And that was what he taught me was that you don’t wait for inspiration. – Tim Ferris Interview, 2021

25. Every writer you know writes really terrible first drafts, but they keep their butt in the chair. That’s the secret of life. That’s probably the main difference between you and them. They just do it. – Ted Talk, 2017

26. My brother was in tears because his fourth-grade term paper on birds was due, and he hadn’t started. So my dad put his arm around John and said, “Just take it Bird by Bird, buddy.” He had John read a page in Audubon or Roger Tory Peterson about pelicans, and then write a paragraph in his own words. And then read about chickadees, and put it in his own words. Little by little by little. – Lithub Interview, 2021

27. I teach people to take it really small, Bird by Bird. – Tim Ferris Interview, 2021

28. Hope begins in the dark, the stubborn hope that if you just show up and try to do the right thing, the dawn will come. You wait and watch and work: you don’t give up. – Bird by Bird, 1995

Quotes on Getting Ideas and Dealing with Writers Block

29. I’ve always told my writing students that I think writer’s block is a misnomer. I don’t think we get blocked, but rather that we get empty. We need to fill back up. – Lithub Interview, 2021

30. Instead of sitting at my desk in full clench and despair, I go about accumulating snippets and chunks of cool stuff: I do informal interviews with brilliant friends on childhood, soul, the meaning of life, etc; I take my most articulate friends to marshes and museums, and I write down every brilliant observation either of us has; I look through old photo albums; I read more poetry. In other words, I fill back up. – Lithub Interview, 2021

31. If you don’t know where to start, remember that every single thing that happened to you is yours, and you get to tell it. – Ted Talk, 2017

32. My dad taught me that to be a writer is a decision and a habit. It’s not anything lofty, and it doesn’t have that much to do with inspiration. You have to develop the habit of being a certain way with yourself. – Goodreads Interview, 2012

33. I heard E.L. Doctorow say that writing was like driving at night with the headlights on. You could only see a little ways in front of you, but you could make the whole journey that way. And I think that is the most profound advice I can offer anyone on any topic. – Tim Ferris Interview, 2021

Quotes on Authenticity in Writing

34. If something inside of you is real, we will probably find it interesting, and it will probably be universal. So you must risk placing real emotion at the center of your work. Write straight into the emotional center of things. – Bird by Bird, 1995

35. Good writing is about telling the truth. We are a species that needs and wants to understand who we are. – Bird by Bird, 1995

36. You are going to have to give and give and give, or there’s no reason for you to be writing. You have to give from the deepest part of yourself, and you are going to have to go on giving, and the giving is going to have to be its own reward. – Bird by Bird, 1995

37. You cannot write out of someone else’s big dark place; you can only write out of your own. – Bird by Bird, 1995

Quotes on Self-Doubt and Fear as a Writer

28. I know some very great writers, writers you love who write beautifully and have made a great deal of money, and not one of them sits down routinely feeling wildly enthusiastic and confident. Not one of them writes elegant first drafts. – Bird by Bird, 1995

39. I can never tell what I’m doing when I’m in the middle of publication because I have no confidence. I have terrible self-esteem, along with boundless narcissism. It’s complicated in here! – Goodreads Interview, 2012

40. I don’t think you have time to waste not writing because you are afraid you won’t be good at it. – Bird by Bird, 1995

Quotes on Perfectionism in Writing

41. Perfectionism is the voice of the oppressor. It’s the voice of the enemy. And if you listen to it, it keeps you crazy for your entire life because we all fall short. – Tim Ferris Interview, 2021

42. I think perfectionism is based on the obsessive belief that if you run carefully enough, hitting each stepping-stone just right, you won’t have to die. The truth is that you will die anyway and that a lot of people who aren’t even looking at their feet are going to do a whole lot better than you, and have a lot more fun while they’re doing it. – Bird by Bird, 1995

43. I don’t try to teach kids or grownups how to write really, really well. I just teach them to stop not writing. I teach to keep their butt in the chair and to write badly. – Tim Ferris Interview, 2021

44. I just believe in flinging yourself into it and writing incredibly terrible first drafts. – Goodreads Interview, 2012

45. All first drafts of any book you’ve ever read by the authors you esteem most began as unreadable first drafts. – Tim Ferris Interview, 2021

46. Almost all good writing begins with terrible first efforts. You need to start somewhere. – Bird by Bird, 1995

47. Perfectionism means that you try desperately not to leave so much mess to clean up. But clutter and mess show us that life is being lived. Clutter is wonderfully fertile ground— you can still discover new treasures under all those piles, clean things up, edit things out, fix things, get a grip. – Bird by Bird, 1995

48. Try looking at your mind as a wayward puppy that you are trying to paper train. You don’t drop-kick a puppy into the neighbor’s yard every time it piddles on the floor. You just keep bringing it back to the newspaper. – Bird by Bird, 1995

49. We need to make messes in order to find out who we are and why we are here – and, by extension, what we’re supposed to be writing. – Bird by Bird, 1995

Quotes on How to Write Well

50. I’ve been over every word in this book a dozen times, and I did notice that I’ve become a pretty decent writer. – Washington Post Interview, 2021

51. At my advanced age, I’ve had to throw a bunch of stuff out of the plane that’s kept me flying too low – including trying to impress New York City editors and writers, which actually made me mentally ill. – Washington Post Interview, 2021

Quotes on Dealing with Challenges in Writing

52. Being a writer guarantees that you will spend too much time alone – and that as a result, your mind will begin to warp. – Bird by Bird, 1995

53. On a bad day you also don’t need a lot of advice. You just need a little empathy and affirmation. You need to feel once again that other people have confidence in you. – Bird by Bird, 1995

54. If people wanted you to write more warmly about them, they should’ve behaved better. – Ted Talk, 2017

Finance Blogs

85+ Inspirational William Zinsser Quotes for Writers

William Zinsser has taught generations of writers the basics of writing well. In this article, we will look at some of his best quotes, drawn from a variety of sources including his books, interviews, and blog.

His quotes offer insight on various issues that you may face as a writer including:

- How do you become a better writer?

- What are the benefits of writing?

- Why should you write what you love?

If you want to learn more about William Zinsser, check out his quick biography.

Quotes on Reasons for Writing

1. We write to find out what we know and what we want to say. I thought of how often as a writer I had made clear to myself some subject I had previously known nothing about by just putting one sentence after another. – Writing to Learn, 1988

2. The writer’s job is like solving a puzzle, and finally arriving at a solution is a tremendous satisfaction – On Writing Well, 1976

3. Writing enables us to find out what we know -and what we don’t know -about whatever we’re trying to learn. – Writing to Learn, 1988

4. Writing is the handmaiden of leadership; Abraham Lincoln and Winston Churchill rode to glory on the back of the strong declarative sentence – Writing to Learn, 1988

5. All writing is ultimately a question of solving a problem. – On Writing Well, 1976

6. Writing is a way to explore a question and gain control over it – Writing to Learn, 1988

7. Writing is an intimate transaction between two people, conducted on paper, and it will go well to the extent that it retains its humanity- On Writing Well, 1976

8. Another reason [for writing] is to paint a portrait of the town or community, now considerably changed, where you grew up. Somewhere on the shelves of every American small-town library and historical society is a makeshift volume, often written by a retired schoolteacher that resuscitates a bygone way of life. – American Scholar Blog, February 18, 2011

9. Writing is also a potent search mechanism, often as helpful as psychoanalysis and a lot cheaper. When you start on your memoir you’ll find your subconscious mind delivering your past to you, recalling people and events you have entirely forgotten. That voyage of rediscovery is a pleasure in itself. – American Scholar Blog, February 18, 2011

10. Writing is a sanity-saving companion for people in times of grief, loss, illness, and other accidents of fate. Just getting down on paper those grim details…will validate your ordeal and make you feel less alone. – American Scholar Blog, February 18, 2011

11. Contrary to general belief, writing isn’t something that only “writers” do; writing is a basic skill for getting through life. – Writing to Learn, 1988

12. Reasoning is a lost skill of the children of the TV generation, with their famously short attention span. Writing can help them get it back. – Writing to Learn, 1988

13. Writers may write for any number of good personal reasons -ego, therapy, recollection, validation of their lives. But what they produce will have a validity of its own to the extent that it’s useful to somebody else. – Writing to Learn, 1988

Quotes on Writing as a Way of Clarify Thinking

14. Writing organizes and clarifies our thoughts. Writing is how we think our way into a subject and make it our own. – Writing to Learn, 1988

15. Clear writing is the logical arrangement of thought; a scientist who thinks clearly can write as well as the best writer. – Writing to Learn, 1988

16. I thought of how often the act of writing even the simplest document -a letter, for instance -had clarified my half-formed ideas. Writing and thinking and learning were the same process. – Writing to Learn, 1988

17. Writing organizes and clarifies our thoughts. Writing is how we think our way into a subject and make it our own. Writing enables us to find out what we know -and what we don’t know -about whatever we’re trying to learn. – Writing to Learn, 1988

18. Putting an idea into written words is like defrosting the windshield: The idea, so vague out there in the murk, slowly begins to gather itself into a sensible shape. Whatever we write -a memo, a letter, a note to the baby-sitter -all of us know this moment of finding out what we really want to say by trying in writing to say it. – Writing to Learn, 1988

19. Probably no subject is too hard if people take the trouble to think and write and read clearly. – Writing to Learn, 1988

20. Writing is thinking on paper, or talking to someone on paper. If you can think clearly, or if you can talk to someone about the things you know and care about, you can write – with confidence and enjoyment. – On Writing Well, 1976

Quotes on How To Write Well

21. You must find some way to elevate your act of writing into entertainment. – On Writing Well, 1976

22. The hardest column to write was the one that taught me the most. – American Scholar Blog, April 29, 2011

23. Make a habit of reading what is being written today and what has been written before. Writing is learned by imitation. – On Writing Well, 1976

24. Examine every word you put on paper. You’ll find a surprising number that don’t serve any purpose. – On Writing Well, 1976

25. Don’t try to visualize the great mass audience. There is no such audience -every reader is a different person. – On Writing Well, 1976

26. Clear thinking becomes clear writing; one cannot exist without the other. – On Writing Well, 1976

27. Most first drafts can be cut by 50 percent without losing any information or losing the author’s voice. – On Writing Well, 1976

28. The most important sentence in any article is the first one. If it doesn’t induce the reader to proceed to the second sentence, your article is dead. And if the second sentence doesn’t induce him to continue to the third sentence, it’s equally dead. – On Writing Well, 1976

29. So decide what single point you want to leave in the reader’s mind. It will not only give you a better idea of what route you should follow and what destination you hope to reach; it will affect your decision about tone and attitude. – On Writing Well, 1976

30. Much of the trouble that writers get into comes from trying to make one sentence do too much work. Never be afraid to break a long sentence into two short ones, or even three. – On Writing Well, 1976

31. Writing improves in direct ratio to the number of things we can keep out of it that shouldn’t be there. – On Writing Well, 1976

32. “Who am I writing for?” You are writing for yourself. Don’t try to visualize the great mass audience. There is no such audience -every reader is a different person. – On Writing Well, 1976

33. Thinking clearly is a conscious act that writers must force on themselves- On Writing Well, 1976

34. Constantly ask yourself: “What am I trying to say?” Then look at what you have written and ask if you have said it. – On Writing Well, 1976

35. Never hesitate to imitate another writer – every person learning a craft or an art needs models. Eventually you’ll find your own voice and will shed the skin of the writer you imitated. – On Writing Well, 1976

36. The best way to learn to write is to study the work of the men and women who are doing the kind of writing you want to do. – On Writing Well, 1976

37. The only way to learn to write is to force yourself to produce a certain number of words on a regular basis. – On Writing Well, 1976

38. Rewriting is the essence of writing well: it’s where the game is won or lost. – On Writing Well, 1976

39. I don’t do tips…It’s not that I don’t have any; On Writing Well, 1976 is full of what might be called tips. But that’s not the point of the book. It’s a book of craft principles that add up to what it means to be a writer Tips can make someone a better writer but not necessarily a good writer. That’s a larger package –a matter of character. – American Scholar Blog, November 5, 2010

40. Golfing is more than keeping the left arm straight. Every good golfer is a complex engine that runs on ability, ego, determination, discipline, patience, confidence, and other qualities that are self-taught. So it is with writers and all creative artists. If their values are solid their work is likely to be solid. – American Scholar Blog, November 5, 2010

41. The essence of writing is rewriting. Very few writers say on their first try exactly what they want to say. – Writing to Learn, 1988

42. Writing is learned by imitation. I learned to write mainly by reading writers who were doing the kind of writing I wanted to do and by trying to figure out how they did it. – Writing to Learn, 1988

43. Students often feel guilty about modeling their writing on someone else’s writing. They think it’s unethical—which is commendable. Or they’re afraid they’ll lose their own identity. The point, however, is that we eventually move beyond our models; we take what we need and then we shed those skins and become who we are supposed to become. – Writing to Learn, 1988

44. He may have been a little high. Beware of dashing. “Effortless” articles that look as if they were dashed off are the result of strenuous effort. A piece of writing must be viewed as a constantly evolving organism. – Writing to Learn, 1988

45. The English language is endlessly supple. It will do anything you ask it to do, if you treat it well. – American Scholar Blog, March 11, 2011

Quotes on What It Takes To Be a Successful Writer

46. Sell yourself, and your subject will exert its own appeal. Believe in your own identity and your own opinions. Writing is an act of ego, and you might as well admit it. Use its energy to keep yourself going. – On Writing Well, 1976

47. Writing is hard work. A clear sentence is no accident. Very few sentences come out right the first time, or even the third time. Remember this in moments of despair. If you find that writing is hard, it’s because it is hard. It’s one of the hardest things that people do. – On Writing Well, 1976

48. A writer will do anything to avoid the act of writing- On Writing Well, 1976

49. Nobody becomes Tom Wolfe overnight, not even Tom Wolfe- On Writing Well, 1976

Quotes on Being Authentic When Writing

50. Write about things that are important to you, not about what you think readers will want to read. Readers don’t know what they want to read until they read it. If it’s important to you it will be important to other people. – American Scholar Blog, August 13, 2010

51. Be yourself and your readers will follow you anywhere. Try to commit an act of writing and your readers will jump overboard to get away. Your product is you. – On Writing Well, 1976

52. If you write for yourself, you’ll reach all the people you want to write for. – On Writing Well, 1976

53. You are writing primarily to please yourself, and if you go about it with enjoyment you will also entertain the readers who are worth writing for. – On Writing Well, 1976

54. Readers want the person who is talking to them to sound genuine. Therefore a fundamental rule is: be yourself. – On Writing Well, 1976

55. I don’t think you should never worry what people think of you. I think you should write whatever you’re writing, you should write entirely for yourself. Don’t try to think what editors want, what publishers want, what agents want. They don’t really know until they see it. So I think the important thing is to get it down. – NPR, 2015

56. As a teacher and as a mentor I give people permission to be who they want to be. – American Scholar Blog, June 4, 2010

57. You must give yourself permission, by a daily act of will, to believe in your remembered truth. Do not remain nameless to yourself. Only you can turn on the switch; nobody is going to do it for you. – American Scholar Blog, June 4, 2010

58. Nobody can make us write what we don’t want to write. – American Scholar Blog, November 5, 2010

Quotes on Education

59. Most Americans look back on their education as a permission-denying experience –a long trail of don’ts and can’ts and shouldn’ts. – American Scholar Blog, June 4, 2010

60. Consider the countless hours we require our children to attend classes and tutoring sessions whose sole purpose is to teach them how to pass college entrance tests–a body of knowledge wholly useless to their growth. – American Scholar Blog, June 4, 2010

61. The fear of writing is planted in countless people at an early age -often, ironically, by English teachers, who make science-minded kids feel stupid for not being “good at words,” just as science teachers make people like me feel stupid for not being good at science. – Writing to Learn, 1988

62. Writing, however, isn’t a special language that belongs to English teachers and a few other sensitive souls who have a “gift for words.” Writing is thinking on paper. Anyone who thinks clearly should be able to write clearly -about any subject at all. – Writing to Learn, 1988

63. Yet most American adults are terrified of the prospect -ask a middle-aged engineer to write a report and you’ll see something close to panic. – Writing to Learn, 1988

Quotes on Working on What You Love and What Is Meaningful to You

64. Motivation is crucial to writing -students will write far more willingly if they write about subjects that interest them and that they have an aptitude for. – Writing to Learn, 1988

65. Try not to acquiesce too quickly in projects that you know aren’t right for who you are. Think about other financial solutions that will free you to focus on the primary task of becoming a writer. – American Scholar Blog, June 3, 2011

66. Give more thought to the longer trajectory of your life. Your most important work-in-progress is not the story you’re working on now. Your most important work-in-progress is you. – American Scholar Blog, June 3, 2011

67. I often think I’m the only teacher who talks about enjoyment as a crucial ingredient in writing. My students seem puzzled that I keep coming back to the subject. – American Scholar Blog, May 14, 2010

68. Writing is serious! Most writers take the act of writing with grim solemnity, fearful that they won’t be worthy of the gods of literature scowling down from Mount Parnassus. Or is it that they take themselves so seriously? – American Scholar Blog, May 14, 2010

69. When I write I make a conscious effort to generate a sense of enjoyment –to convey to my readers that I found the events I’m describing more than ordinarily interesting, or unusual, or amusing, or emotional, or bizarre. Otherwise why bother to describe them? – American Scholar Blog, May 14, 2010

70. I also try to convey the idea that I was feeling great when I did my writing –which I almost never was; writing well is hard work. But readers have a right to believe that you were having a good time taking them on your chosen voyage. – American Scholar Blog, May 14, 2010

71. Only when the job was over did I enjoy it. I don’t like to write, but I take great pleasure in having written. – Writing to Learn, 1988

Quotes on Creativity and Getting Ideas

72. Some of our most creative work gets done in downtime –waking from a nap, taking a walk, daydreaming in the shower…Downtime is when breakthrough ideas are delivered to us, unsummoned, when yesterday’s blockages somehow come unblocked. That’s because we treated ourselves to a little boredom and cleared our brains of the sludge of information. – American Scholar Blog, December 3, 2010

73. Something happened when I actually started to write. The book took on a life of its own and told me how it wanted to be written. – Writing to Learn, 1988

74. An idea can have value in itself, but its usefulness diminishes to the extent that you can’t articulate it to someone else. – Writing to Learn, 1988

Quotes on Writing for Money

75. I know that writers, like everyone else, have to pay the bills. But I believe that blind subservience to an imagined final product is harmful to body and soul and is also often unnecessary. – American Scholar Blog, June 3, 2011

76. Depressingly often I hear from people who are stalled on a piece of writing for reasons that have nothing to do with actual writing. They are snarled in the machinery of trying to market what they write. – American Scholar Blog, June 3, 2011

77. If the process is sound, the product will take care of itself. – Writing to Learn, 1988

78. Ravi’s India memoir also might not get published, but she would be fully alive while writing it. She would grow as a writer and as a person. – American Scholar Blog, June 3, 2011

79. Much of the trouble that writers get into is caused by cart-before-the-horse disease. Writers fixate on the successful final product, forgetting that they will only create that product if they start at the beginning and get the process right. – American Scholar Blog, September 24, 2010

Quotes on Memoirs

80. Memoirs first got a bad name in the mid-1990s. Until that time authors adhered to an agreed-upon code of modesty, drawing a veil over their most shameful acts and feelings. Then talk shows were born and shame went out the window. Overnight, no recollected event was too squalid, no family too dysfunctional, to be trotted out, for the titillation of the masses, on television and in magazines and books. – American Scholar Blog, February 18, 2011

81. Memoir became the new therapy. Everybody and his brother wallowed in their struggle with alcohol, drug addiction, recovery, abuse, illness, aging parents, troubled children, codependency, and other newly fashionable syndromes, meanwhile bashing their parents, siblings, teachers, coaches, and everyone else who ever dared to misunderstand them. It was a new literature of victimhood. – American Scholar Blog, February 18, 2011

82. Nobody remembered those books for more than 10 minutes; readers won’t put up with whining. The memoirs that endure from that period are the ones that look back with love and forgiveness. – American Scholar Blog, February 18, 2011

83. There are many good reasons for writing your memoir that have nothing to do with being published. One is to leave your children and grandchildren a record of who you were and what heritage they were born into. Please get started on that; time tends to surprise us by running out. One of the saddest sentences I know is “I wish I had asked my mother about that.” – American Scholar Blog, February 18, 2011

84. I don’t like people telling other people they shouldn’t write about their life. All of us earn that right by being born; one of the deepest human impulses is to leave a record of what we did and what we thought and felt on our journey. The issue here is not whether so many bad memoirs should be written. It’s whether they should be published. – American Scholar Blog, February 18, 2011

85. Most of those memoirs shouldn’t be published. They are too raw and ragged, too self-absorbed and poorly written, seldom telling us anything we don’t already know. But that doesn’t mean you shouldn’t write them. Don’t worry about the trees. – American Scholar Blog, February 18, 2011

Quotes on Non-fiction Writing

86. Nonfiction writing should always have a point: It should leave the reader with a set of facts, or an idea, or a point of view, that he didn’t have before he started reading. – Writing to Learn, 1988

87. As a nonfiction writer you must anchor your work in specific detail and personal experience that’s useful to your readers. – American Scholar Blog, September 24, 2010

88. Nonfiction writers should always gather far more material than they will use, never knowing which morsel will later exactly serve their needs. – American Scholar Blog, March 11, 2011

Finance Blogs

Louis L’Amour Biography

Louis L’Amour (born Louis Dearborn LaMoore) was an American author best known for novels and short stories. Although he is most famous for his western novels, he has also written poetry, science-fiction, historical fiction, and non-fiction books.

L’Amour was highly prolific. He wrote 100 novels and numerous short stories (over 250 by some estimates). His books have sold over 320 million copies and have been translated into 20 languages. He also wrote numerous screenplays and television scripts. Several of his books (at least 30) have been made into films.

Louis L’Amour’s life story is a colorful as the characters he writes about in his books. He was born in Jamestown, North Dakota, US on March 22, 1908. His father was a veterinarian and his mother was a teacher.

His comfortable childhood ended in 1923 when, after a series of bank failures ruined the economy of the upper Midwest, the family had to move to look for work. This meant that Louis and his brother John had to leave school. Louis was 15 at the time.

During these difficult years, Louis worked all kinds of jobs. He worked in cattle farms, mines, sawmills, and lumber camps. He also spent time as a professional boxer and merchant seaman. His work as a merchant seaman enables him to travel around the world, visiting England, Japan, China, Borneo, the Dutch East Indies, Arabia, Egypt, and Panama.

In the early 1930s, during the great depression, he settled in Choctaw, Oklahoma, to start his writing career. In 1939, at the age of 31, he published a book of poetry and several short stories. His writing career was interrupted by the outbreak of the Second World War. In 1942 (at the age of 35) he joined the US army transportation corps and spent time in France and Germany.

He continued with his writing career after the war in 1946. From 1946 to 1950, he wrote many short stories for various magazines under the pseudonym “Jim Mayo.” He also wrote four novels as “Tex Burns.”

The first novel he wrote under his real name was Westward the Tide (1951). In 1953, he wrote Hondo, which became a hit and sold 1.5 million copies. In 1954, Hondo was made into a highly successful film starring John Wayne. The rest, as they say, is history.

In 1983, L’Amour became the first novelist to be awarded the Congressional Gold Medal. He was also awarded the Medal of Freedom in 1984.

L’Amour died from lung cancer at the age of 80 (on 10 June 1988). His autobiography, Education of a Wandering Man (1989), was published shortly after.

-

Blogger Earnings6 months ago

Blogger Earnings6 months agoLegit Blogger Earnings: 70 Blog Income Reports from Successful Bloggers

-

Finance Blogs5 months ago

70+ Inspirational Jeff Goins Quotes for Writers

-

Blogger Earnings6 months ago

Blogger Earnings6 months ago10 Inspiring Crafts Blogs Income and Traffic Reports ($3,000+ monthly)

-

Blogger Earnings6 months ago

Blogger Earnings6 months agoHow Much Money Can You Realistically Make From Blogging? (Blogger Income Survey Data)

-

How To6 months ago

How To6 months agoHow to Create a WordPress Blog from Scratch: A Step-by-Step Complete Beginner’s Guide (2025)

-

Finance Blogs6 months ago

Finance Blogs6 months agoBlogging Statistics 2022: 270+ Useful Statistics for Growing Your Online Presence

-

Blogger Earnings6 months ago

Blogger Earnings6 months ago13 Real Mom Blogs Income and Traffic Reports ($3,000+ monthly)

-

Blogger Earnings6 months ago

Blogger Earnings6 months ago12 Inspiring Travel Blogs Income and Traffic Reports