Business

TraceLoans | Simplify Your Loan Tracking Today

Managing multiple loans can quickly become overwhelming, especially when juggling due dates, payments, and balances across different lenders or loan types. Whether you’re an individual borrower, a small business owner, or managing organizational finances, staying on top of your loans is crucial to maintaining healthy financial well-being.

This is where TraceLoans steps in. By offering an all-in-one solution to track loans efficiently, TraceLoans empowers individuals and organizations to simplify their financial management and eliminate the guesswork from loan tracking.

This blog explores how TraceLoans can streamline your loan management process, highlights its key features, and explains why it’s the ideal choice for anyone looking to take control of their financial portfolio.

What is TraceLoans?

TraceLoans is an innovative loan tracking platform designed to simplify complex financial management. It centralizes all your loan information in one easy-to-use interface, making it effortless to monitor due dates, track payment history, and visualize balances.

No more spreadsheets, missed payments, or endless back-and-forth communication with lenders— provides precise and reliable oversight of your loans, helping you stay financially accountable.

Why Efficient Loan Management Matters

Effectively managing loans isn’t just about ensuring your payments are made on time; it directly influences your credit score, financial growth, and peace of mind. Poor loan tracking can lead to missed payments, accumulating interest, and potential penalties.

Furthermore, without a clear view of your loan portfolio, it becomes challenging to make informed decisions such as refinancing or allocating payments to high-interest debts. provides clarity, enabling a more strategic approach to loan management.

Key Features of TraceLoans

TraceLoans isn’t just a tracking tool—it’s a comprehensive platform designed with your specific financial needs in mind. Here’s what makes TraceLoans stand out from the competition:

1. Centralized Dashboard

Tired of bouncing between loan statements, online banking portals, and spreadsheets? TraceLoans aggregates all your loan data onto a single, user-friendly dashboard.

- Access all loans in one place, regardless of lender or type (e.g., personal loans, mortgages, student loans).

- Gain an instant overview of current balances, due dates, and interest rates in real-time.

2. Payment Tracking and Reminders

Never miss a payment again. TraceLoans keeps track of all upcoming due dates and ensures you’re notified in advance.

- Set up customizable alerts for payment reminders.

- View your payment history to maintain accountability and accuracy.

3. Interest and Principal Insights

Understanding how much of your payments go toward principal versus interest is key to seeing the bigger picture.

- Analyze breakdowns of your payments to optimize repayment strategies.

- Monitor how much interest you’ve accrued over time and plan accordingly.

4. Loan Comparison and Refinancing Opportunities

Don’t settle for high-interest rates. TraceLoans identifies potential refinancing opportunities to save you money.

- Compare your existing loans with lower-rate alternatives in real time.

- Explore strategies to pay off higher-interest loans first while minimizing costs.

5. Custom Reporting and Analytics

Transparency is essential to financial success. TraceLoans offers insightful reporting features to keep you informed.

- Generate detailed reports to visualize your overall debt trends.

- Access forecasts to see how additional payments or refinancing can impact your loan term.

6. Secure and Confidential

Your personal and financial data is safe with TraceLoans. The platform is built on robust, industry-standard security measures.

- Enjoy encrypted data storage for peace of mind.

- Limit access to your account with multi-factor authentication.

Benefits of Using TraceLoans

What makes TraceLoans an essential tool for borrowers? Beyond its intuitive features, it provides tangible benefits for financial health and decision-making.

Enhance Financial Clarity

Gone are the days of scattered loan documents or missed payment due dates. By consolidating everything, TraceLoans gives you the clarity needed to see the full picture.

Save Time and Effort

Manual loan tracking can be cumbersome and error-prone. TraceLoans automates key processes, saving you time and energy.

Avoid Late Penalties

With real-time reminders and tracking, you’ll never worry about late fees or missed due dates again.

Optimize Repayment Strategies

The platform empowers you to make informed decisions, like targeting high-interest loans or reevaluating your repayment priorities.

Gain Peace of Mind

When your financial management is seamless, you can focus on other personal or professional goals with confidence.

Who Can Benefit from TraceLoans?

TraceLoans is tailor-made for anyone who manages loans. Here’s a look at some of the key users benefiting from the platform:

- Individual Borrowers who juggle multiple personal or student loans.

- Small Business Owners seeking a better way to manage business debt.

- Organizations responsible for overseeing corporate loans or financing.

- Loan Advisors in need of analytical tools to guide their clients effectively.

If you owe money and want to track it smarter, TraceLoans is for you.

How to Get Started with TraceLoans

Getting started with TraceLoans is fast and easy. Follow these three simple steps to simplify your loan tracking today:

- Create an Account

Sign up with your email address and verify your identity to unlock secure access.

- Add Your Loans

Manually input your loan information or automate the process by integrating with financial institutions.

- Track and Optimize

Start managing your loans effortlessly with insights, reminders, and detailed analytics at your fingertips.

Sign Up for Free Today

Why Choose TraceLoans Over the Competition?

Unlike traditional loan-tracking methods such as spreadsheets or bank apps, TraceLoans offers a comprehensive, user-centric approach. With its advanced analytics, secure infrastructure, and customizable features, surpasses generic tools tailored for the average user.

Investing in TraceLoans means trusting a platform designed explicitly for high-performing financial management.

Take Control of Your Loans Today

Your financial health is too important to leave to chance. TraceLoans provides the tools and insights you need to simplify loan tracking, optimize payments, and reduce financial stress.

With TraceLoans, managing loans doesn’t have to be overwhelming—it can be empowering.

Start Your Free Trial Today

Final Thoughts

Achieving financial stability starts with having the right tools to manage your debts effectively. TraceLoans combines innovation, reliability, and ease of use to help you stay on top of your finances with confidence. Whether you’re juggling multiple loans or striving to streamline your repayments, our platform is your trusted partner on the road to financial freedom.

Don’t wait to take control of your financial future. Join countless others who have made the switch to smarter, stress-free loan management. Try today and experience the difference for yourself.

Conclusions

TraceLoans stands out as a comprehensive solution for modern loan management, designed to simplify and empower your financial decisions. By providing intuitive tools and unmatched support, it enables users to take control of their debts while working toward lasting financial stability. The path to financial freedom begins with making informed, strategic moves, and is here to guide you every step of the way. Empower yourself today—because your finances deserve nothing less than exceptional care and precision.

FAQs

1. What is TraceLoans?

TraceLoans is an innovative platform designed to simplify loan management. It offers tools to track, organize, and strategize your loan repayments effectively while empowering you to make smarter financial decisions.

2. Is TraceLoans secure?

Yes, TraceLoans prioritizes your security and privacy. We utilize advanced encryption and robust security protocols to ensure your personal and financial information is fully protected.

3. Who can benefit from using TraceLoans?

TraceLoans is ideal for anyone managing one or multiple loans. Whether you’re a student with education loans, a homeowner with a mortgage, or someone repaying personal loans, TraceLoans provides valuable insights and solutions tailored to your needs.

4. Can TraceLoans work with my current loans?

Absolutely. TraceLoans is designed to integrate with a variety of loan types, including student loans, mortgages, personal loans, and more. It adapts to your unique situation to provide a seamless management experience.

5. How do I get started with TraceLoans?

Getting started is easy. Simply sign up on our website, set up your account, and input your loan details. From there, you’ll gain access to the full suite of tools to start managing your loans more effectively today.

If you have further questions, don’t hesitate to reach out to our customer support team via our website! We’re here to help you every step of the way.

Business

Explore Hsnime | Your Destination for Anime Streaming and Community Connections

![Explore Hsnime | Your Destination for [Keyword Specific Detail]](https://indiebounty.com/wp-content/uploads/2025/03/search-bar-background-blurred-photo-girl-with-leather-suitcase-travel_494741-18439-1.jpg)

Anime has taken the entertainment world by storm, captivating audiences with its unique storylines, breathtaking animation, and deeply relatable characters. Whether you’re a lifelong fan or a newcomer looking to explore the genre, finding a reliable platform that offers high-quality streaming, community connections, and an extensive library can make all the difference. That’s where Hsnime steps in.

Hsnime isn’t just another streaming service. It’s a comprehensive platform where anime enthusiasts can watch their favorite shows, discover new series, and engage with a vibrant community of like-minded fans. This blog post will introduce you to Hsnime, explain its features, and show why it stands out as your go-to anime destination.

Why Anime Deserves Your Attention

Before we get into the specifics of Hsnime, let’s take a moment to recognize why anime has become so widely loved across the globe. From timeless classics like Naruto and Sailor Moon to modern masterpieces such as Attack on Titan and Jujutsu Kaisen, anime transcends typical storytelling. Unlike other media, anime covers a wide spectrum of genres, including action, romance, fantasy, comedy, and slice-of-life, ensuring there’s something for everyone.

Anime fandom also brings together people from different walks of life, fostering a sense of belonging and a shared passion. When you take that love for anime and pair it with the right platform, such as Hsnime, the experience becomes even more immersive and enjoyable.

What is Hsnime?

Hsnime is more than just a streaming service. It’s a dedicated hub for anime lovers, offering a blend of robust streaming options, thoughtful user experience, and a connected community. Whether you’re itching to binge-watch classics or stay up-to-date with the latest simulcasts, Hsnime has got you covered.

Here’s what makes Hsnime a standout platform:

- A massive library of anime, updated regularly with new and trending titles.

- High-definition streaming with minimal buffering time, ensuring a seamless viewing experience.

- User-friendly navigation tools that make searching for specific genres, series, or episodes quick and easy.

- Tailored content recommendations based on what users love to watch.

- Exclusive access to an engaged community of anime fans who share reviews, memes, fan art, and more.

Key Features of Hsnime

1. Extensive Library of Shows and Movies

From heartwarming series like My Neighbor Totoro to action-packed blockbusters like Demon Slayer, Hsnime boasts an expansive catalog that spans anime genres and styles. Whether you’re after retro classics or the hottest new releases, the platform is carefully curated to cater to every kind of viewer.

- Old Favorites: Rewatch legendary series like One Piece and Dragon Ball Z.

- Ongoing Episodes: Catch the latest episodes of seasonal anime airing in Japan.

- Hidden Gems: Discover underrated anime that deserve more attention.

Thanks to regular updates, there’s always something fresh to explore.

2. High-Quality Streaming

No one enjoys interruptions during a climactic battle scene or final confession of love. That’s why Hsnime delivers high-definition video playback with smooth streaming, even during peak hours. Depending on your bandwidth, users can choose between SD, HD, and ultra-HD resolutions.

3. Personalized Recommendations

With so many titles to choose from, where do you even begin? Hsnime’s AI-driven recommendation system helps solve that problem by analyzing your viewing patterns and curating content tailored specifically to your tastes. If you loved Haikyuu!!, Hsnime might suggest similar sports anime like Kuroko’s Basketball. Or if you’re drawn to dark psychological thrillers, you might be encouraged to check out Erased.

4. Built-in Community Features

Anime isn’t just something you watch; it’s something you discuss, dissect, and celebrate. Hsnime provides built-in community tools where fans can:

- Participate in discussion threads about their favorite shows or characters.

- Post reviews and reading recommendations.

- Connect with others who share similar interests in forums or chatrooms.

These features help transform passive viewing into an active, social experience.

5. Flexible Membership Options

Hsnime is accessible to everyone with free and premium membership plans.

- Free Membership allows users to enjoy ad-supported streaming, perfect for casual viewers.

- Premium Membership removes ads, unlocks simulcasts immediately after they air in Japan, and provides offline downloads for on-the-go viewing.

The affordable premium pricing ensures that quality anime remains accessible to fans everywhere.

Why Choose Hsnime Over Other Platforms?

With so many anime platforms out there, what makes Hsnime the obvious choice?

- Greater Variety: Hsnime’s library rivals that of any other competitor in terms of both breadth and depth. You’ll find cult classics and lesser-known gems side by side.

- Exclusive Features: Access a vibrant community and enjoy features like offline downloads and simulcasts that elevate the viewing experience.

- Superior User Experience: Hsnime’s intuitive interface allows even total newcomers to find their way around the platform quickly.

- Accessibility for All: Both free and premium options make it easier to enjoy anime without unnecessary restrictions.

- Commitment to Fans: Built by anime lovers, for anime lovers, Hsnime is run with a deep understanding of fan expectations.

How to Get Started with Hsnime

Getting started on Hsnime couldn’t be easier! Follow these simple steps:

- Visit the Website: Head over to Hsnime.com to get started.

- Sign Up: Create your free account and start exploring instantly.

- Explore the Library: Browse by genre, title, or popularity to find your first watch.

- Opt for Premium: Upgrade to premium for uninterrupted HD streaming.

What’s more, new users can try premium features free for their first week. There’s never been a better time to explore Hsnime.

Final Thoughts

Anime fans know that finding the right streaming service can make or break their viewing experience. Hsnime isn’t just an anime platform; it’s a space where passion meets innovation. With an unparalleled collection of shows, high-quality streaming options, and community-driven tools, Hsnime ensures you’re not just watching anime, you’re living it.

Are you ready to take your anime obsession to the next level? Head over to Hsnime today and start exploring the best titles, one episode at a time.

Business

scoopupdates .com: Your Source for Timely Updates

In a world overflowing with information, finding credible and timely updates can feel like searching for a needle in a haystack. Enter scoopupdates.com—a powerful platform designed to streamline your news consumption. This innovative site curates essential information across various topics, making it easier than ever to stay informed without the noise of misinformation. Whether you’re interested in current events or lifestyle trends, scoopupdates.com has something for everyone looking to cut through the clutter and access reliable content quickly. Ready to explore how this digital hub can transform your online experience? Let’s dive in!

The Need for Curated Information in the Digital Age

In today’s fast-paced digital landscape, information is abundant. Yet, with this wealth comes confusion. Users often find themselves overwhelmed by the sheer volume of content available online.

Curated information serves as a beacon in this chaos. It helps sift through the noise to deliver what truly matters. People seek trustworthy sources that provide accurate updates without unnecessary clutter.

As we navigate social media and countless websites, curated platforms like scoopupdates.com rise to prominence. They filter essential news and insights tailored to our interests.

This approach saves time while ensuring that users stay informed about relevant topics. It’s not merely about quantity; quality holds far greater significance in our quest for knowledge today. Well-curated content fosters an engaged audience eager for meaningful discussions and fresh perspectives on pressing issues.

scoopupdates .com: A Commitment to Accuracy and Timeliness

At scoopupdates.com, accuracy is non-negotiable. Every piece of information undergoes rigorous verification before it’s shared with readers. This meticulous approach ensures that you receive only the most reliable updates.

Timeliness is equally essential. In a fast-paced world where news travels at lightning speed, staying current can be challenging. Scoopupdates.com prioritizes delivering fresh content promptly to keep you in the loop.

The team behind scoopupdates.com understands that informed readers make better decisions. By focusing on these core values—accuracy and timeliness—they provide a platform you can trust for all your informational needs.

This commitment extends beyond mere facts; it’s about building credibility within a noisy digital landscape. When you turn to scoopupdates.com, you’re choosing a source dedicated to enhancing your understanding of the world around you without compromise.

Features and Functionality of scoopupdates .com

Scoopupdates.com boasts a user-friendly interface that makes navigation seamless. Visitors can easily access the latest updates without any hassle.

The site features an intuitive search function, allowing users to find specific topics quickly. This efficiency saves precious time in today’s fast-paced world.

Categorized information is another standout feature. Users can explore various sections such as news, lifestyle, and entertainment with just a click. Each category is regularly updated to ensure relevance.

A mobile-responsive design ensures that scoopupdates.com looks great on any device. Whether you’re at your desk or on the go, staying informed has never been easier.

Interactive elements engage readers further, promoting community discussions around trending topics. Comment sections invite opinions and foster dialogue among users.

Notifications keep subscribers informed about breaking news and special features tailored to their interests—perfect for anyone who wants timely updates delivered straight to them.

How to Stay Connected with scoopupdates.com

Staying connected with scoopupdates.com is simple and convenient. You can subscribe to the newsletter for regular updates delivered straight to your inbox. This ensures you never miss a breaking story or important announcement.

Follow scoopupdates.com on social media platforms like Twitter, Facebook, and Instagram. Engaging with posts allows you to interact directly and join conversations around trending topics.

For real-time information, enable notifications on your devices. This way, you’ll receive instant alerts about new articles that matter most to you.

Explore the website frequently for fresh content across various categories. Visiting regularly helps you stay in tune with evolving stories and insights.

Feel free to engage by leaving comments or sharing opinions on articles that resonate with you. Your participation helps create a vibrant community of informed readers eager for more timely updates.

The Potential Impact of scoopupdates.com

scoopupdates.com has the potential to reshape how we consume information. In a world flooded with data, it acts as a beacon for clarity and relevance.

By providing timely updates across various topics, users can easily access vital information without wading through endless articles. This streamlined approach saves time and enhances productivity.

Moreover, scoopupdates.com fosters informed discussions. When people engage with accurate content, they contribute to more meaningful conversations in their communities.

The platform also encourages diverse perspectives. Users can explore multiple viewpoints on current events or trending topics, enriching their understanding of different issues.

With its commitment to accuracy and timeliness, scoopupdates.com may very well become an essential tool for anyone seeking reliable information in our fast-paced digital landscape.

Top Categories on Scoopupdates.com

Scoopupdates.com offers a variety of categories tailored to fit every reader’s interests. Whether you’re seeking the latest news or unique lifestyle stories, there’s something for everyone.

The News section keeps you updated on current events happening around the world. From politics to technology, it covers diverse topics that matter most.

For those interested in entertainment, the Lifestyle category dives into trends in fashion, travel, and wellness. You’ll discover tips and inspiration to enhance your daily life.

Opinion pieces provide thoughtful analysis on pressing issues. These insights encourage discussion and reflection among readers.

Don’t miss out on updates about sports. Stay informed on major games and athlete achievements as they happen.

With such a wide array of content available at scoopupdates.com, you’ll always find engaging material that resonates with your passions and curiosity.

Opinion Pieces and Analysis

At scoopupdates.com, opinion pieces and analysis are crafted with care. Each article delves into current events, offering fresh perspectives that provoke thought.

Writers explore intricate topics, dissecting them for readers who seek depth beyond the headlines. This platform encourages critical thinking and spirited debates among its audience.

The voices featured here range from seasoned journalists to passionate commentators. Their insights provide a mosaic of viewpoints on pressing issues shaping our world today.

Readers can expect well-researched content that challenges conventional wisdom while remaining accessible. These pieces foster engagement and spark conversations in various communities.

Whether you’re interested in politics or social trends, there’s something for everyone at scoopupdates.com. The analyses aim not just to inform but also to inspire action and understanding among readers navigating the digital landscape.

Lifestyle and Entertainment Updates

Lifestyle and entertainment updates on scoopupdates.com keep you in the loop with what’s trendy. From fashion tips to celebrity news, this platform covers it all.

Discover fresh insights into lifestyle choices that resonate with today’s audience. Whether you’re looking for new recipes or wellness advice, you’ll find a treasure trove of inspiration.

For those who love movies and music, stay tuned for reviews and sneak peeks at upcoming releases. The latest buzz around your favorite stars is just a click away, making it easier to engage with pop culture.

Explore various events happening near you or online. Be it concerts, exhibitions, or festivals—scoopupdates.com ensures you’re never out of touch with exciting happenings in the entertainment world.

Dive deep into engaging articles that spark conversations about trends shaping our lives today. This section truly embodies the essence of living well while staying entertained.

Conclusion: Stay Informed with scoopupdates .com

Staying informed is more important now than ever. With the vast amount of information available online, it can be challenging to find reliable sources that deliver timely updates. Scoopupdates.com fills this gap by offering curated news and insights tailored to your interests.

Whether you’re looking for opinion pieces, lifestyle tips, or entertainment news, scoopupdates.com has you covered. The platform’s commitment to accuracy ensures that readers receive trustworthy content you can rely on. By staying connected with scoopupdates.com through social media or newsletters, you’ll always have access to the latest happenings.

As we navigate this digital age together, embracing platforms like scoopupdates.com empowers us all to stay engaged and informed about what matters most. For anyone seeking a fresh perspective on current events and trends, it’s worth checking out today.

Business

Ashcroft Capital Lawsuit: A Legal Perspective

The real estate investment world is often seen as a playground for the savvy and well-informed. However, lurking beneath the surface can be unexpected challenges that shake even the most established players. One such instance has emerged with the Ashcroft Capital lawsuit, capturing attention across financial news outlets and investor circles alike. This legal battle raises critical questions about ethics, accountability, and risk management within one of America’s booming multifamily markets.

As investors scramble to understand what this means for their portfolios, we delve into Ashcroft Capital’s background and its strategic approach to investments. With allegations surfacing regarding operational practices within the firm, it becomes essential to dissect these claims and evaluate their potential ramifications—not just for Ashcroft Capital but also for investors navigating this complex landscape. Join us as we unravel the intricacies of this lawsuit and explore valuable lessons that all stakeholders in real estate should consider moving forward.

Background: Ashcroft Capital and its Investment Strategy

Ashcroft Capital, founded by Joe Ashcroft and his team, focuses on multifamily real estate investments. Their strategy revolves around acquiring and managing apartment communities across the United States.

The firm places a strong emphasis on value-add opportunities. This means they look for properties that can be improved through renovations or operational efficiencies. By increasing property values, they aim to maximize returns for their investors.

Their approach often targets emerging markets where demand is rising. They analyze local demographics thoroughly to ensure sustainable growth potential.

They also prioritize investor transparency and education throughout the investment process. This builds trust with stakeholders who are keen on understanding the nuances of real estate investing.

Through these strategies, Ashcroft Capital has carved out a niche in the competitive landscape of real estate investment firms.

Legal Analysis of the Allegations

The legal landscape surrounding the Ashcroft Capital lawsuit is complex. Allegations often stem from investment practices that raise eyebrows in the real estate sector.

Investors claim mismanagement and lack of transparency. This has resulted in financial losses that many consider avoidable. The scrutiny on these claims highlights potential breaches of fiduciary duty.

Legal experts emphasize the importance of documentation and due diligence in such cases. Failure to provide clear information can lead to significant repercussions for management firms like Ashcroft.

Moreover, any regulatory violations could amplify penalties or further investigations. Courts may also assess whether investors were adequately informed about risks associated with their investments.

As this case unfolds, it serves as a reminder for all stakeholders involved—both investors and property managers—to be vigilant about compliance standards within an ever-evolving market.

The Core Allegations of the Ashcroft Capital Lawsuit

The Ashcroft Capital lawsuit centers around serious allegations of misconduct. Investors have raised concerns about misrepresentation and potential fraud in the company’s operations.

Key claims suggest that the firm may have overstated projected returns on investments. This has left many feeling deceived, questioning their financial decisions based on these inflated figures.

Additionally, there are accusations regarding inadequate communication with investors. Some claim they were not properly informed about risks associated with specific properties within the portfolio.

These core allegations paint a troubling picture for Ashcroft Capital’s reputation. Investor trust hangs in the balance as legal proceedings unfold and details emerge from ongoing investigations. The implications of this lawsuit could resonate well beyond just one company or its stakeholders.

Potential Consequences for Ashcroft Capital

The Ashcroft Capital lawsuit could have far-reaching impacts on the firm’s reputation and operations. Legal battles often divert attention from core business activities, leading to potential financial strain.

Investors may grow wary, questioning not only the firm’s integrity but also its future profitability. This uncertainty could result in a decline in investment interest or even an exodus of current investors.

Furthermore, if found liable for any wrongdoing, Ashcroft Capital might face hefty fines or settlements. Such financial repercussions can severely limit capital available for future projects.

Additionally, industry peers will likely observe closely how this situation unfolds. The outcome may influence market perceptions regarding risk management within real estate investment firms.

All these factors combined create a precarious environment for Ashcroft Capital as they navigate through legal challenges while striving to maintain investor confidence and operational stability.

Lessons Learned for Real Estate Investors

The Ashcroft Capital lawsuit serves as a stark reminder of the complexities in real estate investing. Investors often assume that high returns come without risk, but this case illustrates otherwise.

Due diligence is essential. Always investigate the track record of investment firms. Scrutinize their strategies and past performance before committing your capital.

Transparency matters greatly in any investment opportunity. Ensure you fully understand where your money goes and how it’s managed. Clear communication can prevent misunderstandings and disputes down the line.

Furthermore, diversification should be part of every investor’s strategy. Relying too heavily on one asset class or firm can lead to significant losses if things go wrong.

Staying informed about legal developments within the industry is crucial for all investors. Knowledge is power, especially when navigating potential pitfalls like those seen with Ashcroft Capital.

Implications for Investors and the Multifamily Market

The Ashcroft Capital lawsuit has sent ripples through the multifamily investment landscape. Investors are now more cautious, weighing risks against potential returns. Legal disputes can shake investor confidence and alter market dynamics significantly.

As scrutiny increases, due diligence becomes paramount. Investors may rethink their strategies, focusing on transparency and compliance to avoid similar pitfalls. Trust in management teams will be pivotal moving forward.

Moreover, this case highlights the importance of understanding legal frameworks within real estate investments. Multifamily properties are often seen as stable; however, this incident reveals vulnerabilities that could impact valuation and attractiveness in the eyes of institutional investors.

In a competitive market, those who adapt quickly to emerging challenges will likely gain an edge. This lawsuit serves as a powerful reminder that vigilance is just as critical as capital allocation in achieving long-term success within the sector.

Conclusion: A Case Study in Real Estate Investment Risks

The Ashcroft Capital lawsuit serves as a significant case study in the multifaceted world of real estate investment. It highlights the risks that can arise when allegations of mismanagement or unethical practices surface. Investors and stakeholders alike must consider the implications of such legal challenges on their portfolios and overall market confidence.

As this situation unfolds, it will be crucial for current and potential investors to stay informed about developments within Ashcroft Capital. The outcome may set precedents affecting how investment firms operate and how they are scrutinized by both regulators and the public.

Furthermore, this case underscores the importance of due diligence before engaging with any investment firm. Understanding an organization’s strategy, reputation, and past performance is vital in mitigating risk exposure in real estate investments.

Real estate remains a lucrative option for many; however, lessons from lawsuits like these cannot be ignored. They remind us all that vigilance is essential in navigating opportunities while safeguarding against potential pitfalls inherent in any financial endeavor.

-

Finance Blogs10 months ago

70+ Inspirational Jeff Goins Quotes for Writers

-

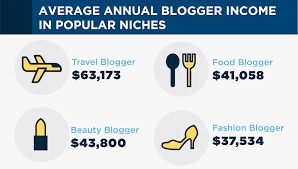

Blogger Earnings11 months ago

Blogger Earnings11 months agoLegit Blogger Earnings: 70 Blog Income Reports from Successful Bloggers

-

How To11 months ago

How To11 months agoHow to Create a WordPress Blog from Scratch: A Step-by-Step Complete Beginner’s Guide (2025)

-

Blogger Earnings10 months ago

Blogger Earnings10 months agoHow Much Money Can You Realistically Make From Blogging? (Blogger Income Survey Data)

-

Blogger Earnings10 months ago

Blogger Earnings10 months ago10 Inspiring Crafts Blogs Income and Traffic Reports ($3,000+ monthly)

-

Finance Blogs10 months ago

12 Personal Finance Blogs Income Reports

-

Finance Blogs10 months ago

Finance Blogs10 months ago40+ Inspirational Ernest Hemingway Quotes for Writers

-

Finance Blogs10 months ago

Finance Blogs10 months ago40+ Inspiring Neil Gaiman Quotes for Writers